The Ultimate Guide to Property Valuation in Kenya

MV

Understanding Property Valuation

Property valuation is a crucial aspect of the real estate market in Kenya. It involves determining the market value of a property, which is essential for various purposes such as buying, selling, taxation, or investment. Understanding how valuations work can help property owners and potential buyers make informed decisions.

The process of property valuation in Kenya considers several factors, including the location of the property, its size, condition, and any unique features. A thorough valuation can provide an accurate estimate of a property's worth, ensuring that all parties involved in a transaction are on the same page.

The Importance of Accurate Property Valuation

Accurate property valuation is vital for both buyers and sellers. For sellers, it ensures they receive a fair price for their property. For buyers, it helps in negotiating a reasonable price and securing financing from lenders. Additionally, accurate valuations are crucial for determining property taxes and insurance premiums.

Moreover, investors rely on precise valuations to assess the potential return on investment. An undervalued property might present an opportunity, while an overvalued one could lead to financial losses. Hence, engaging a professional valuer is often recommended.

Factors Influencing Property Valuation in Kenya

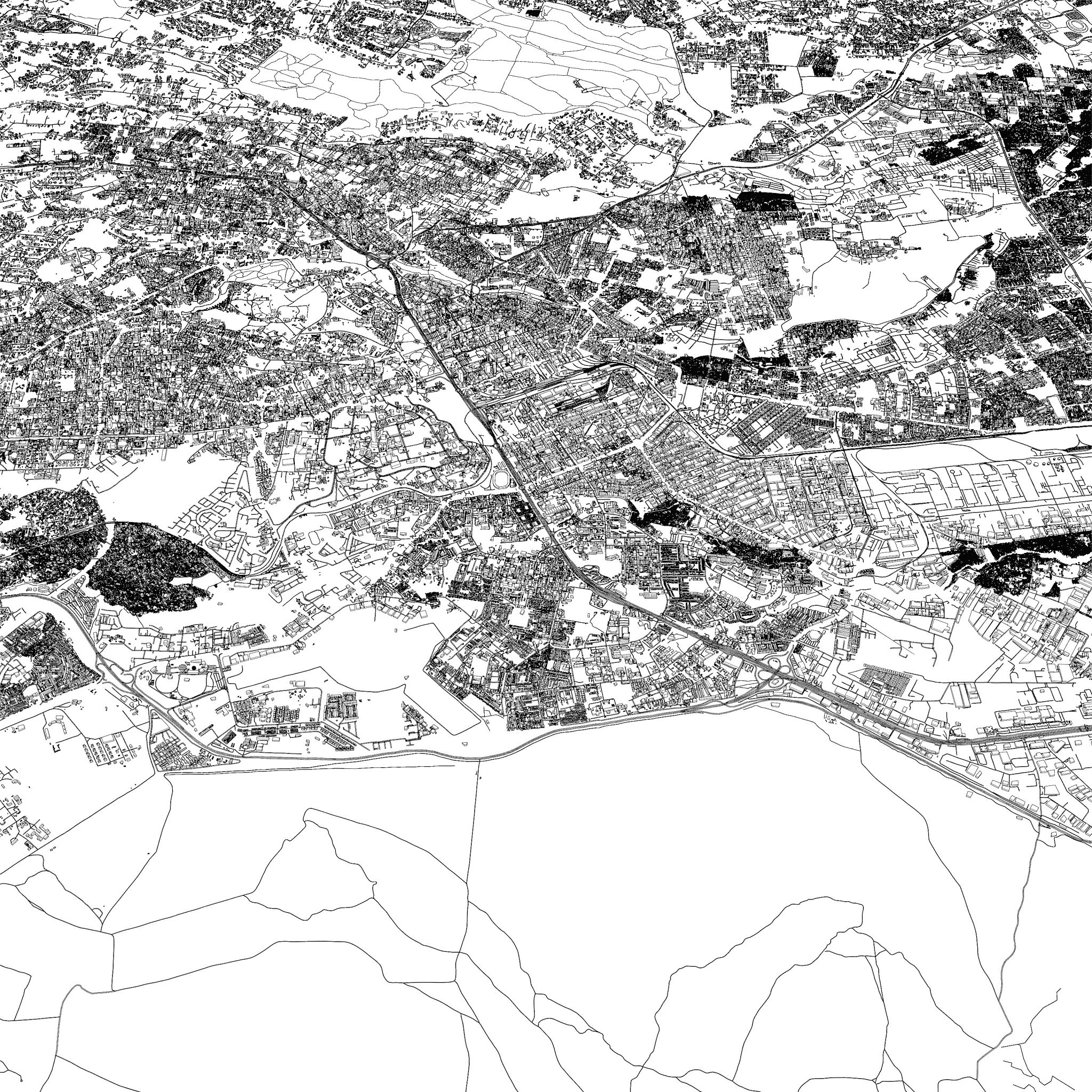

Several factors influence property valuation in Kenya. One of the primary factors is location. Properties in prime areas such as Nairobi or Mombasa tend to have higher valuations compared to those in rural settings. Accessibility to amenities like schools, hospitals, and shopping centers also plays a significant role.

Another critical factor is the condition and age of the property. Newer or well-maintained properties typically have higher valuations. Additionally, the size of the land and any improvements made, such as renovations or additions, can significantly impact the property's value.

The Valuation Process

The valuation process often involves a professional valuer conducting a physical inspection of the property. During this inspection, they assess the property's condition, measure its dimensions, and take note of any unique features. They may also review recent sales data of similar properties in the area to reach an accurate valuation.

Valuers often use different methods to value a property, including the sales comparison approach, income approach, or cost approach. Each method has its unique advantages and is chosen based on the type of property being evaluated.

Choosing a Professional Valuer

To ensure an accurate and reliable property valuation, it is essential to hire a qualified and experienced valuer. In Kenya, valuers should be registered with the Valuers Registration Board and adhere to professional standards. It's advisable to conduct due diligence by checking credentials and seeking recommendations before selecting a valuer.

Working with a reputable valuer not only guarantees an accurate valuation but also ensures compliance with legal requirements. This can be particularly important when dealing with financial institutions or legal transactions.

Conclusion

Property valuation is an integral part of the real estate landscape in Kenya. Whether you are buying, selling, or investing, understanding how valuations work can significantly impact your decisions. By considering the factors that influence valuation and engaging with professional valuers, stakeholders can ensure they make sound financial choices in the property market.